idaho sales tax rate 2021

What is the sales tax rate in Idaho Falls Idaho. Did South Dakota v.

Sales Tax Laws By State Ultimate Guide For Business Owners

The Idaho sales tax rate is currently.

. This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for Post Falls Idaho is. Average Sales Tax With Local.

Wayfair Inc affect Idaho. The 2018 United States Supreme Court decision in South Dakota v. 31 rows The state sales tax rate in Idaho is 6000.

2021 Idaho State Sales Tax Rates The list below details the. The County sales tax rate is. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

A retailer is any individual business nonprofit organization or government agency that does any of the following. Tax rates are provided by Avalara and updated monthly. The Post Falls sales tax rate is.

Counties and cities can charge an. Has impacted many state nexus laws and sales tax collection requirements. The minimum combined 2022 sales tax rate for Ola Idaho is.

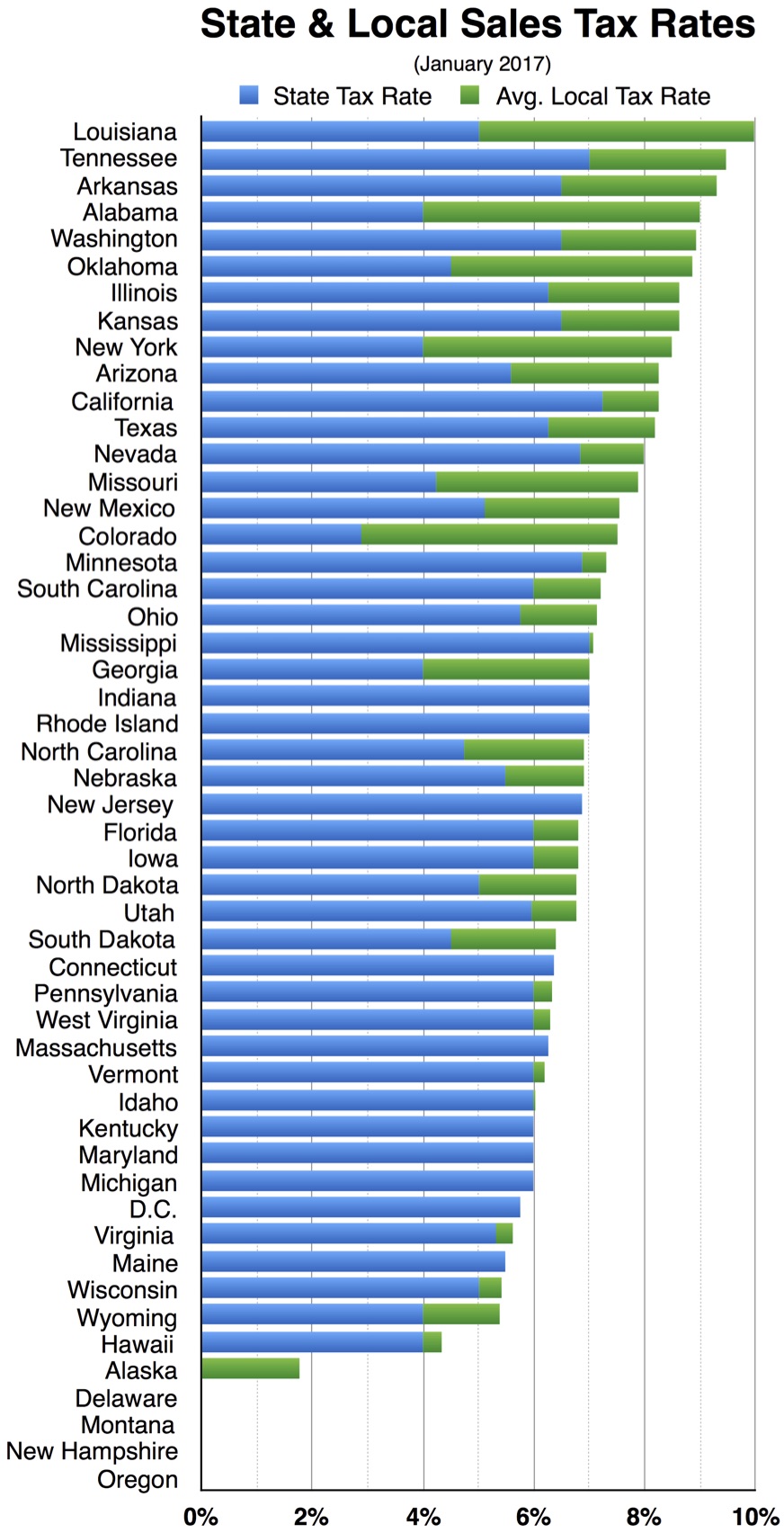

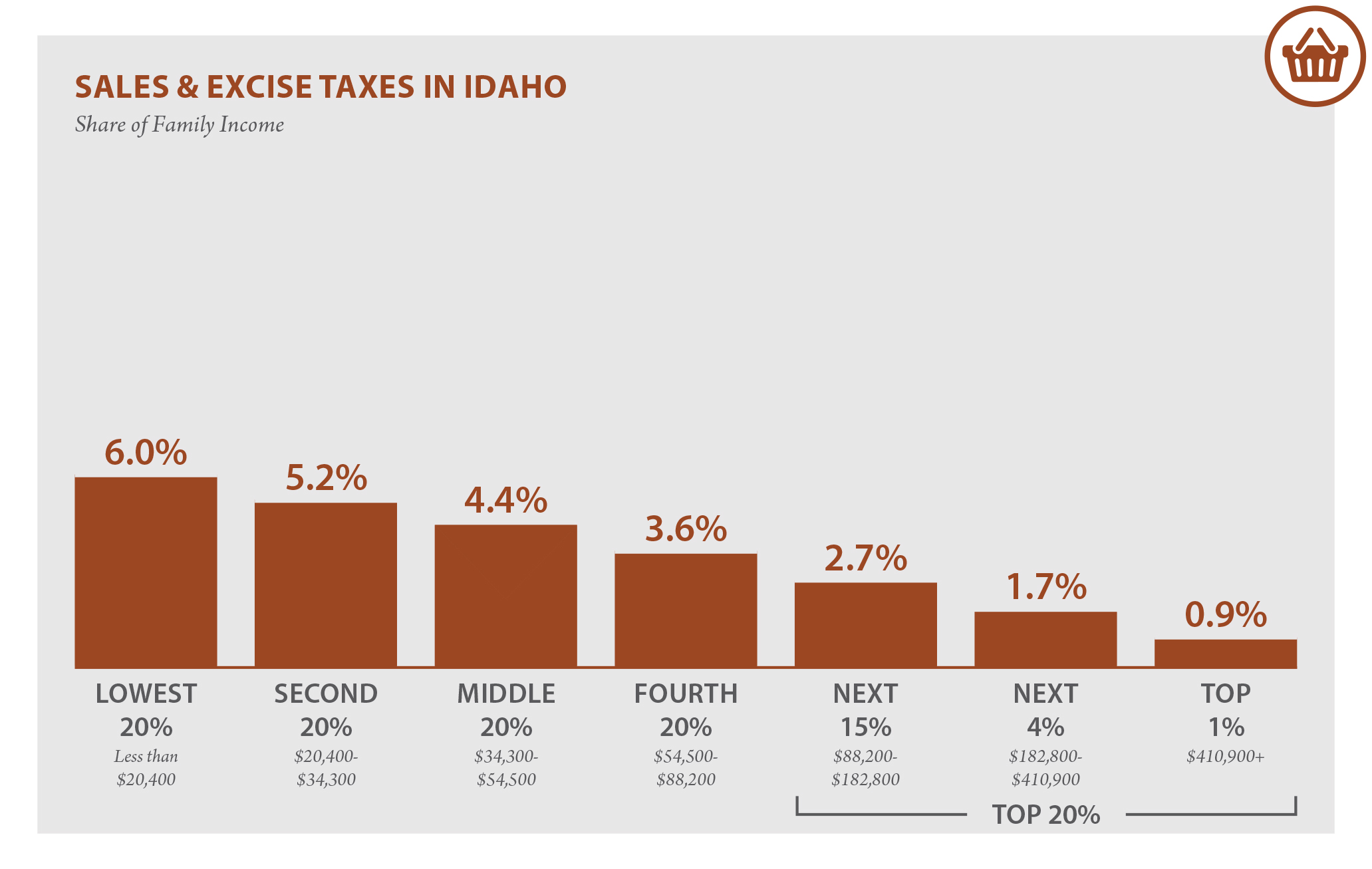

Idaho has state sales tax of. The current Idaho sales tax rate is 6. Local tax rates in Idaho range from 0 to 3 making the sales tax range in Idaho 6 to 9.

Find your Idaho combined state and local tax rate. To review the rules in Idaho visit our state-by-state guide. We have tried to include all the cities that come under.

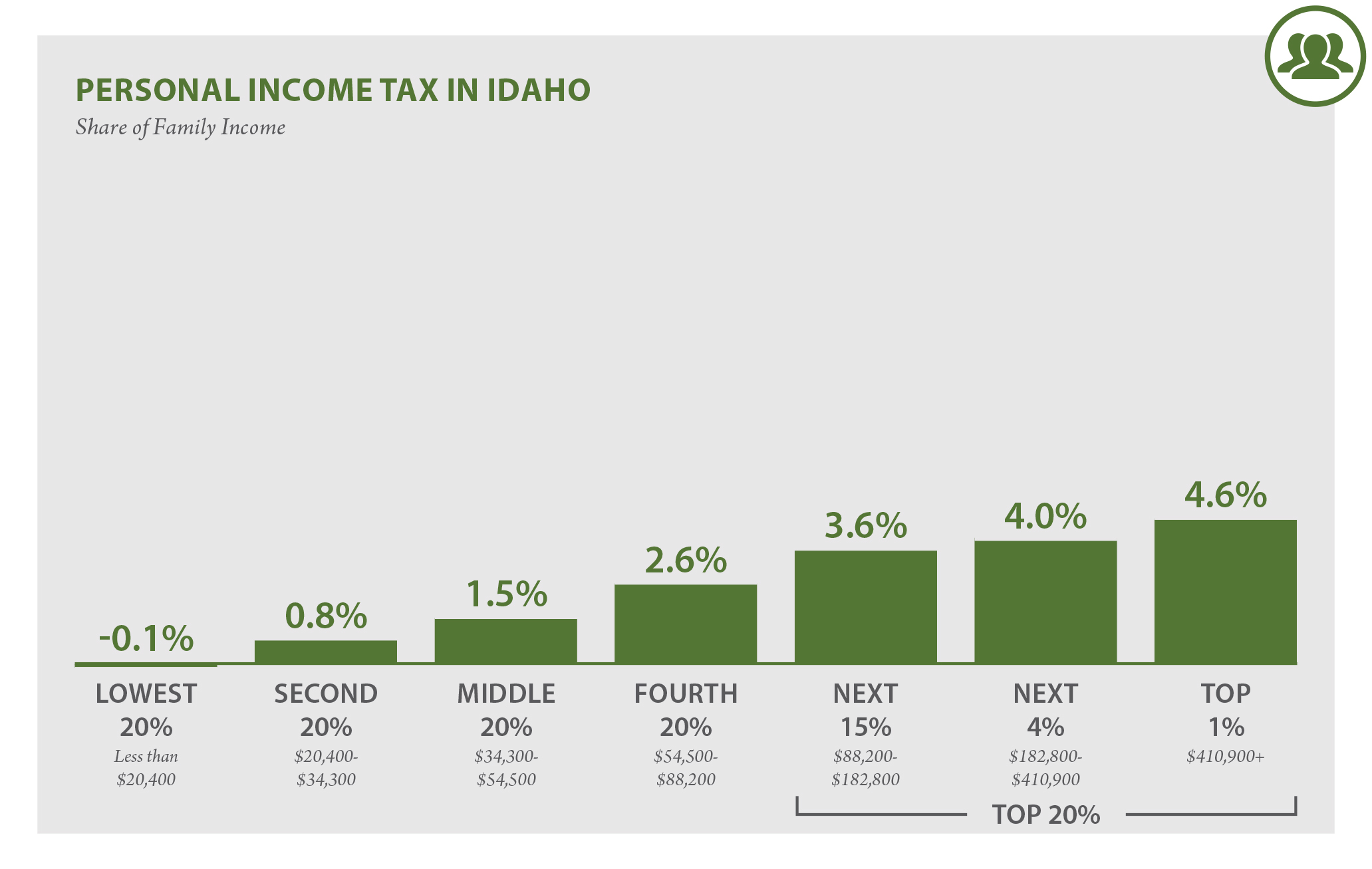

The corporate income tax rate is now 65. For individual income tax rates now range from 1 to 65 and the number of tax brackets dropped from seven to five. Automating sales tax compliance can help your business keep compliant with changing sales tax laws.

With local taxes the total sales tax rate is between 6000 and 8500. This is the total of state county and city sales tax rates. Idaho Sales Tax Rates 2021.

Taxidahogovindrate For years. Look up 2021 Idaho sales tax rates in an easy to navigate table listed by county and city. The five states with the highest average local sales tax rates are Alabama 522 percent Louisiana 507 percent Colorado 475 percent New York 452 percent and.

Lowest sales tax 6 Highest sales tax 9 Idaho Sales Tax. The Idaho sales tax rate is currently. Idaho has a 6 statewide sales tax rate but also has.

Sells to a consumer who wont resell or lease the product. Idaho has reduced its income tax rates. You can find your sales tax rates using the below table please use the search option for faster searching.

Income tax rates for 2021 range from 1 to 65 on Idaho taxable income. The County sales tax rate is. Did South Dakota v.

Free sales tax calculator tool to estimate total amounts. Lower tax rates tax rebate. 280 rows 2022 List of Idaho Local Sales Tax Rates.

Wayfair Inc affect Idaho. The Ada County sales tax rate is. This is the total of state county and city sales tax rates.

The Ola sales tax rate is. With local taxes the total sales tax rate is. Look up 2022 sales tax rates for Atlanta Idaho and surrounding areas.

Look up 2022 sales tax rates for Sugar Loaf Idaho and surrounding areas. 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 Calculate your tax rate based upon your taxable income the first two. The minimum combined 2022 sales tax rate for Boise Idaho is.

The Idaho sales tax rate is currently. Tax rates are provided by Avalara and updated monthly. For individual income tax the rates range from 1 to 6 and the number of.

This is the total of state county and city sales tax rates. The 2018 United States Supreme Court decision in South Dakota v. The minimum combined 2022 sales tax rate for Idaho Falls Idaho is.

The corporate tax rate is now 6. The base state sales tax rate in Idaho is 6. The use tax rate is the same as the sales tax rate.

2021 Idaho Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Prescription Drugs are exempt from the Idaho sales tax. The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601.

Individual income tax is graduated. The County sales tax rate is. This means that Idaho taxes higher earnings at a higher.

Idaho State Tax Return Etax Com

Idaho State Taxes 2021 Income And Sales Tax Rates Bankrate

Idaho Who Pays 6th Edition Itep

Idaho Who Pays 6th Edition Itep

State Income Tax Rates And Brackets 2021 Tax Foundation

State Of Idaho Projecting Another Record Budget Surplus As Legislature Prepares To Return Idaho Capital Sun

State By State Guide To Taxes On Middle Class Families Kiplinger

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Largest Tax Cut In Idaho History Signed By Governor Ktvb Com

Idaho Sales Tax Rates By City County 2022

Are There Any States With No Property Tax In 2022 Free Investor Guide

Sales Tax Calculator And Rate Lookup 2021 Wise

Census 2020 Data Illustrates Idaho S Urban Rural Divide Idaho Capital Sun

Tax Shift Of 2006 Adds Up To Tax Increase

Bill That Would Let Some Snap Users Buy Prepared Food Has Bipartisan Support Sdpb

Sales Tax 2021 Lookup State And Local Sales Tax Rates Wise

States Without Sales Tax Article

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute